Estate Planning simplified

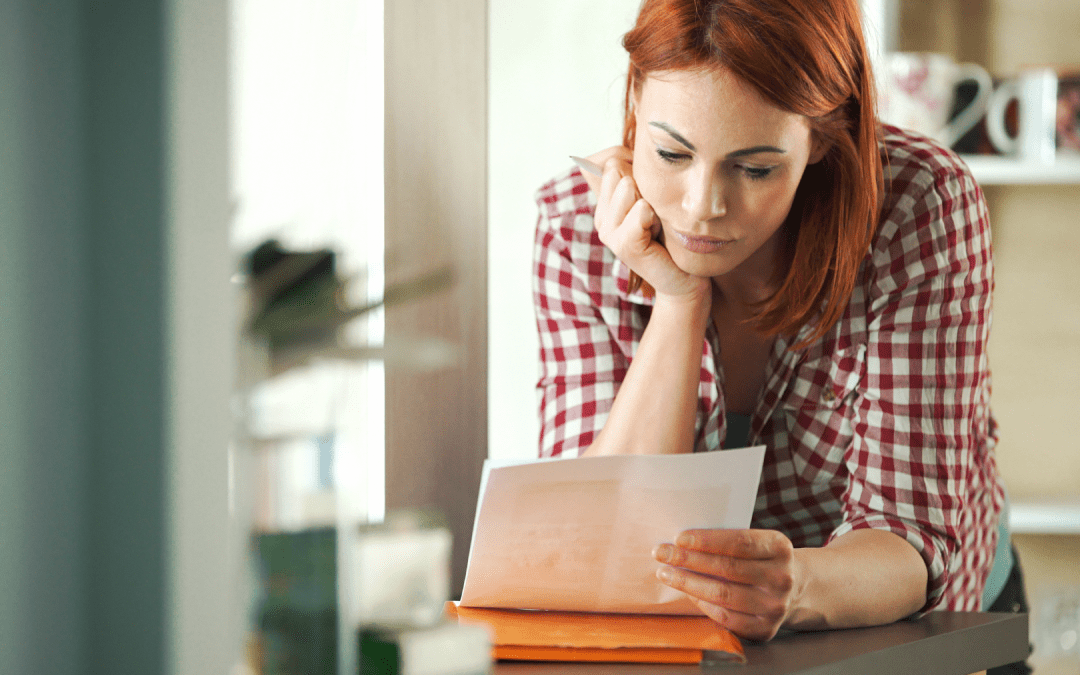

Growing older comes with many challenges but estate planning does not need to be one of them. It is important to prepare for medical emergencies and the distribution of your estate. Take advantage of your LegalShield membership to begin the estate planning process.

Your LegalShield provider law firm is ready to draft your will and help answer your questions.

- Prepare a Will and estate plan so that upon your death your assets will pass exactly as you intend. Do you want a state law, rather than you, to decide who inherits your estate? Completing a will questionnaire is the first step to creating your will. You may now access the LegalShield will questionnaire directly through the LegalShield app. You may download the LegalShield App for your iPhone or Android device. You may also call LegalShield Member Services or your provider firm to have a questionnaire mailed to you.

- Prepare a Durable Power of Attorney so that someone you trust can make decisions on your behalf in the event you are unable to do so. Who do you want to handle your affairs if you are unable to?

- Prepare an Advanced Medical Directive (Living Will) so that someone is empowered to make medical decisions on your behalf and in accordance with your wishes if you cannot. Do you want life support if you become totally and permanently incapacitated?

- Prepare retirement and disability plans so that your care upon retirement or disability is not left to chance. Is Social Security (Old Age Security in Canada) enough to sustain you?

- Review all private and governmental benefits to which you may be entitled, including life and health insurance, government assistance programs, private pension and benefit plans, to ensure that you receive the maximum benefits to which you are entitled. Do you know all of the military, retirement and other benefits you are entitled to?

- Prepare a comprehensive summary of assets and benefits, including all bank accounts, savings accounts, CDs and other assets together with all benefits for which you are or may be eligible. Can your lawyer in fact readily identify all of your assets and benefits?

- Prepare an Important Papers Packet containing vital documents and your comprehensive summary of assets and benefits. The packet should include copies of your Social Security card, life insurance policies, will, military discharge papers, medical alerts, names and addresses of your physicians, immunization records, other important medical information, including allergies, deeds, and titles or bills of sale of particularly valuable property, such as fine jewelry. How will your lawyer in fact or executor find your important papers?