Creating a Will

Almost all adults know what a Will does, but very few know what goes into it, and about half of Americans have not taken the time to create one. We’re generally not very good at planning for the distant future, likely because we very much want to believe that we have years and decades left in our lives. But part of our responsibility to our family is preparing for our passing and making sure that the legal aspects of our affairs are as organized and manageable as possible. That’s why it’s never too early to learn why a Will is vital, and why you need one, no matter your age.

What is a Will?

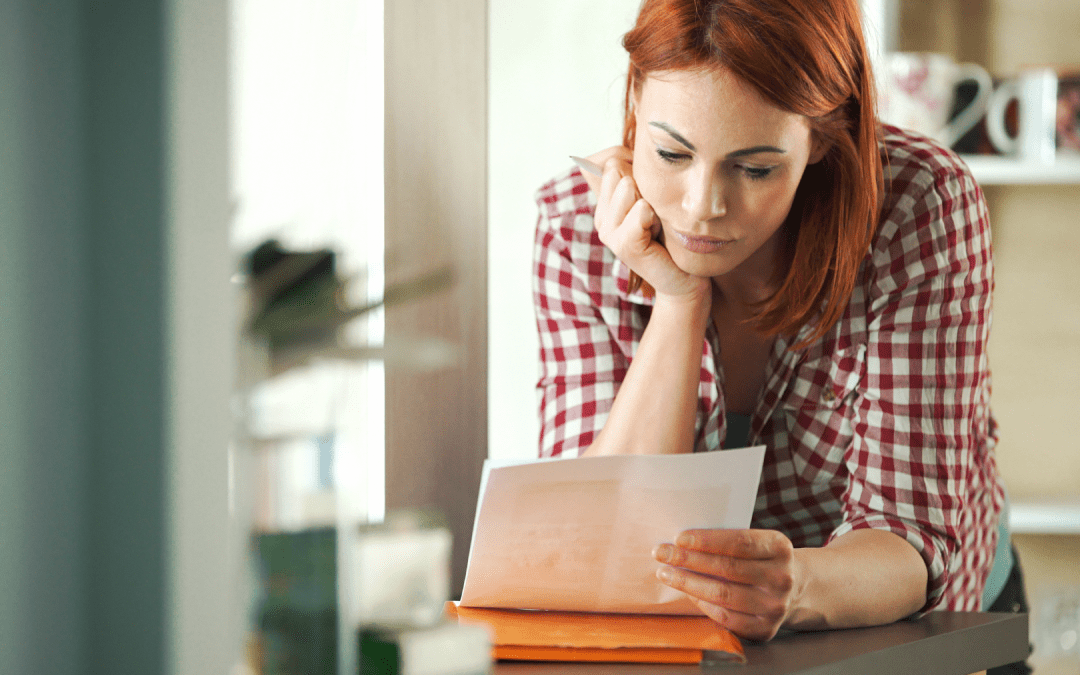

A Will is a document that communicates your wishes for your estate — your financial and physical assets, as well as owned real estate — and plans for the guardianship of children or adults under your care. While you might not feel as though you own much of great value, you want to make sure it’s all distributed in a way of your choosing. Plus, it’s important to ensure that those you care for have someone who can offer that same level of care in your absence.

How a Will helps your family

Creating a Will can save your family the hassle of a more protracted legal process upon your death. If you pass away without a Will, it’s referred to as having died intestate. It doesn’t mean that your assets and belongings are lost to your family forever, or that they end up the property of the state. Instead, your estate is simply subject to a process called intestate succession, whereby the law of the state determines the distribution of your assets depending on the remaining family or heirs, typically to your closest remaining relative(s). And while that’s perhaps not the worst outcome, it might not be what you have in mind; a Will makes certain that things pass to the people you’ve chosen.

More crucially, questions of guardianship are left to the courts if you die without a Will. You may not feel strongly about the disposition of your earthly possessions, but you certainly want to provide for the wellbeing of your child or children. You might think it’s less of an issue if you’re survived by the child’s other parent, but you have to plan for the possibility that you both pass away simultaneously. Without a guardian being determined through your Will, it’s another matter that is left to the courts to determine, regardless of what your wishes may have been. A trustee or conservator is normally the term for the person(s) you choose to take care of the financial matters for children until they reach a certain age. The same person(s) can be named as the guardian and trustee but you can decide if you want a different person(s) in those roles.

Choosing an executor for your Will

The executor sometimes referred to as a personal representative, of your Will is another important position that requires a trusted individual. Your executor or personal representative is responsible for administering your Will and estate — guiding your family through the probate process and handling all the administrative tasks that come with settling the remaining matters of your life. That person has considerable responsibility given the work and time it may take to get through the entire process, so due consideration is warranted in choosing an executor or personal representative. It doesn’t need to be the person closest to you — in fact, you might be well served in finding someone slightly removed from your immediate family — but it has to be someone responsible that can be trusted with this duty. Ideally, you should consider selecting an alternate or successor executor or personal representative in case your initial choice is unable to serve in that role.

Keeping your Will up-to-date

Updating your Will isn’t something that is normally done quarterly or even annually, but you do want to evaluate whether your circumstances have changed enough to warrant updating your Will. Annual updates of your Will and consultation are benefits provided under your membership. There are plenty of reasons you may want to update your Will: births, deaths, marriages and divorces and any number of material changes to what you own and who is part of your life. When it’s time to update your Will, you should contact your provider law firm. This is an area where, if not done properly, your family can run into issues.

Can my Will be contested?

Not everyone may be happy with the Will you’ve created, and regardless of what you do, there is never a guarantee that your Will won’t be contested. In contesting your Will, they may try to demonstrate that you weren’t mentally competent when creating the Will, or that the Will is invalid on other legal grounds. Again, a reason to have a lawyer involved in your estate planning.

What is not addressed in my Will?

For all that a Will covers, there are plenty of things that can’t be included or require separate arrangements. You may have specific wishes for your funeral but given the possibility that the Will won’t be read and executed until after your service, you’ll want to set out separate instructions. Certain assets normally pass outside your Will and estate such as anything that has a beneficiary(ies) designated, is payable on death or property that is jointly held. You should discuss these and other issues with your provider lawyer at the time you create your estate planning documents.

Why do I need a LegalShield lawyer?

There’s no law stating that you can’t create your own will, but there are plenty of reasons to seek out a lawyer for your estate planning. However, there are specific requirements as to what needs to be in different types of Wills and plenty of considerations that a lawyer can provide counsel on. Using a lawyer for Wills, Powers of Attorney, and all the other important legal documents needed to protect yourself and your family ensures that you’re not making critical mistakes that could render the documents invalid or useless.

LegalShield Members can get help from a provider lawyer with a Will, without having to worry about the expense. Plans start at $29.95 a month and include valuable estate planning advice and documents, including a Will, at no extra charge.

LegalShield provides access to legal services offered by a network of provider law firms to LegalShield Members through member-based participation. Neither LegalShield nor its officers, employees or sales associates directly or indirectly provide legal services, representation or advice. See a plan contract at legalshield.com for specific state of residence for complete terms, coverage, amounts, and conditions. This is not intended to be legal or medical advice. Please contact a medical professional for medical advice or assistance and a lawyer for legal advice or assistance.