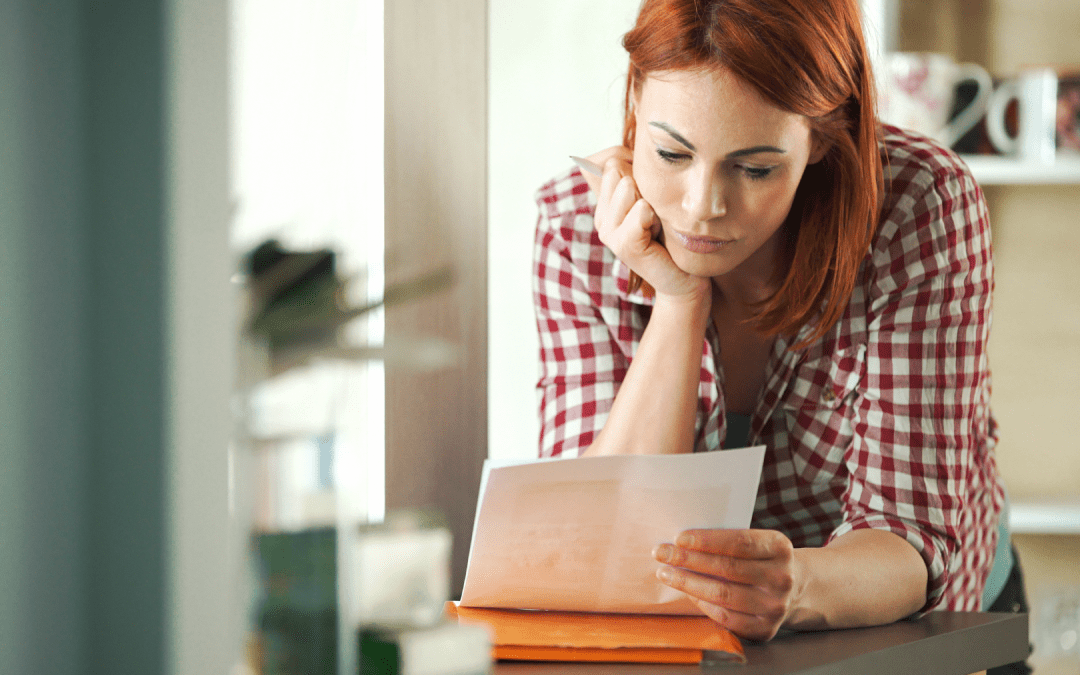

One of the greatest benefits of a LegalShield policy is the Will package. The process of obtaining your Will begins with completing the LegalShield Will Questionnaire. You can complete the Will Questionnaire via the LegalShield app, which you can download from the iTunes or Android store. You may also obtain a Will Questionnaire by calling LegalShield, your provider law firm or logging into the member’s only portal.

The LegalShield provider law firm uses the information you provide to develop an estate plan that meets your specific needs. The following tips are designed to help answer some common questions about the questionnaire.

- Answer every question listed. If the question does not apply to you, mark it as N/A (not applicable). This will indicate to the lawyer that you read and acknowledged the question.

- If you have a property settlement agreement from a previous marriage, please send a duplicate copy of the agreement to your provider firm with your completed Will Questionnaire. Providing the attorney with a copy of the settlement agreement will help them draft a Will that meets your needs.

- Before naming a guardian and an alternate guardian talk to them and make sure they are willing to serve. It’s important that anyone you select be willing and able to accept the responsibility.

- Your trustee does not need to be the same individual as your guardian. The trustee manages the property. Make sure the individual you select understands your wishes and agrees to serve. If you have substantial assets you may wish to name a corporate trustee, such as a bank or trust company. A corporate trustee is paid for their service so it’s important to understand the fees and regulations before selecting a company.

- Question 15 allows you to indicate how you would like your assets to pass upon your death. Options A and B provide for common distributions for married and unmarried individuals respectively. Option C allows you to write out your wishes if A and B do not meet your needs. If you need more space to complete this or any other question, submit the additional information to your provider firm via email, fax or mail.

- You do not need to list specific account numbers or your Social Security number on the Will Questionnaire. The amounts requested in section 20 may be reasonable estimates. If these amounts change drastically, contact your provider law firm and speak with a lawyer.

- Do not hesitate to ask questions. If you have questions about a specific portion of the questionnaire or general estate planning questions, it’s important that you speak with a lawyer. If you have any questions or need any additional clarification, call your LegalShield provider law firm today.