Many people assume all of their bank accounts, investments and insurance policies will be distributed according to their Last Will and Testament, but this may not be the case. These types of accounts, including checking accounts, life insurance, retirement portfolios and IRAs, often require a beneficiary designation when they are established. The individual(s) you name at that time will receive the funds from the account when you die. These accounts are considered “payable on death,” meaning the assets transfer at the time of your death without regard to your Will.

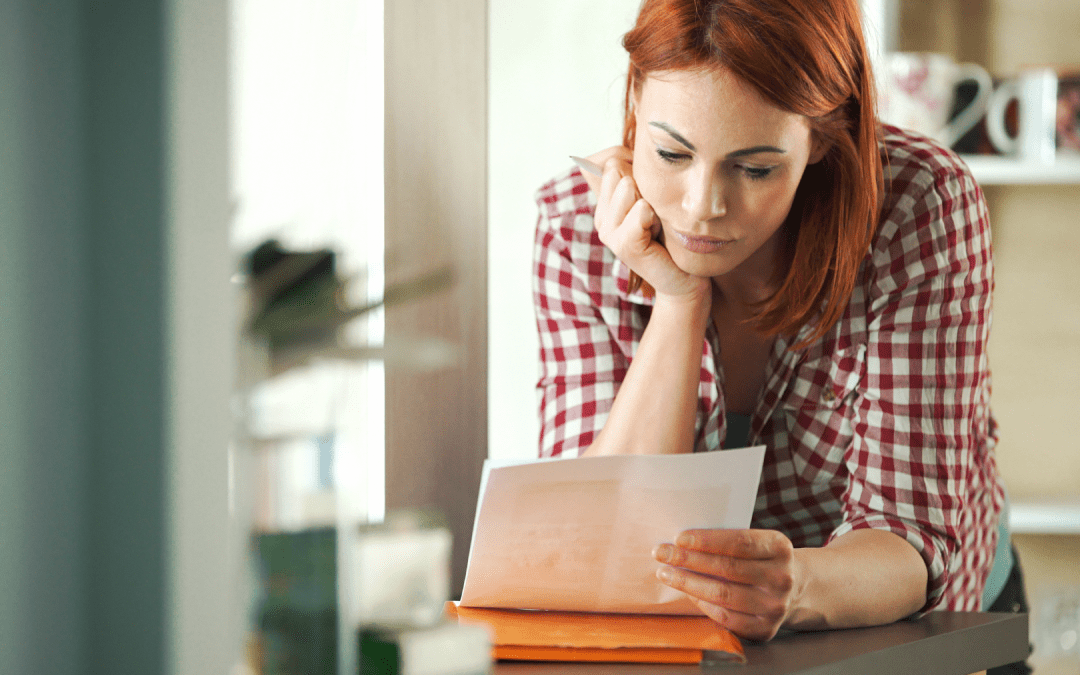

In some cases, forgetting to update the beneficiary designation could mean your wishes and the reality of how your assets are distributed will differ greatly. Accounts may have been established prior to marriage, the birth of children or even during a previous marriage. This means your children or your current spouse would not receive assets from the account when you die.

It’s important to act quickly. Beneficiary designations can only be altered while you are living and of sound mind. You may want to change the beneficiary designation to a particular family member or a current spouse. You may prefer to designate your estate as the beneficiary so the assets will be distributed according to your Will.

Deciding how to handle any accounts with a beneficiary designation is an important part of the estate planning process. Talk to your LegalShield provider law firm to learn more about your options.